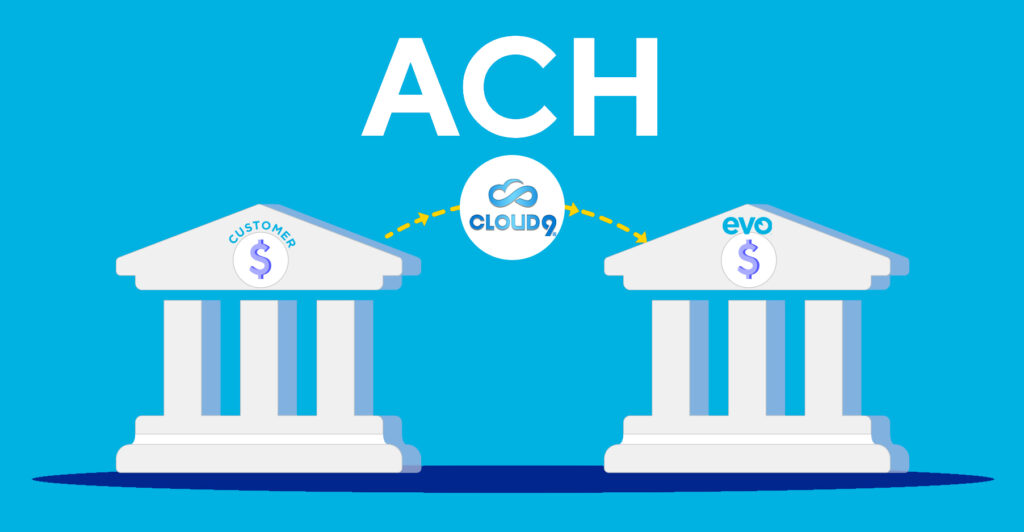

ACH – A Secure System for Transferring Funds Between U.S. Bank Accounts

Created in the 1970s, the ACH Network, or Automated Clearing House, is an important part of the U.S. banking system. In fact, just about every U.S. bank allows customers to transfer and receive funds via ACH.

The ACH Network helps banks save money by not having to process and store paper checks – and because no paper check is involved, it significantly reduces fraud for banks and consumers alike.

Because of fraud, the ACH system has seen a steady increase in usage. The U.S. Postal Service, for example, reported a surge in mail theft from more than 840 financial institutions between February and August 2023. Treasury’s Financial Crimes Enforcement Network (FinCEN) said mail theft-related check fraud cases amounted to more than $688 million in suspicious activity. (Source)

And, mail theft isn’t only related to financial institutions; towns and cities across the U.S. have seen a rise in mailbox theft; the thieves steal mail looking for gift cards, cash, and checks. Checks are then literally washed to remove ink and then rewritten for tens of thousands of dollars. (Source)

Push – Pull Transactions

ACH allows businesses to “pull” funds from customers’ bank accounts once the customer sets up the transaction. Think bill paying or scheduled transactions for goods or services.

“Push” transactions allow bank customers to send funds to businesses, people, other financial institutions, and even the U.S. Government. For example, business and individual tax payers can pay taxes through the government’s EFTPS portal.

Same Day ACH available since 2016

With the advent of PayPal and services such as Zelle®, consumers and businesses can send funds in real time. However, these methods are costly due to fees.

Same day ACH transactions have been growing steadily since its inception in 2016; YoY growth in same day payments for 2024 is 45.3% — with $3.23 trillion dollars transferred.

ACH therefore, remains one of the best options for sending and receiving funds securely and at lower cost. Fees can vary by institution, but typically include:

- Flat fee per transaction – $.20 to $1.50

- Percentage fees – 0.5% to 1.5% of the transaction amount

- Monthly or batch processing fees – These can range from $5 to $30 per month, depending

Larger transaction sizes and recurring payments reduce per-transaction fees, making ACH ideal for medium-to-large businesses. (Source)

Cloud 9 users can pay for their invoices via ACH, if you need help getting set up, contact us today!